- +91 9840697692

- codeplusetech@gmail.com

Follow Us :

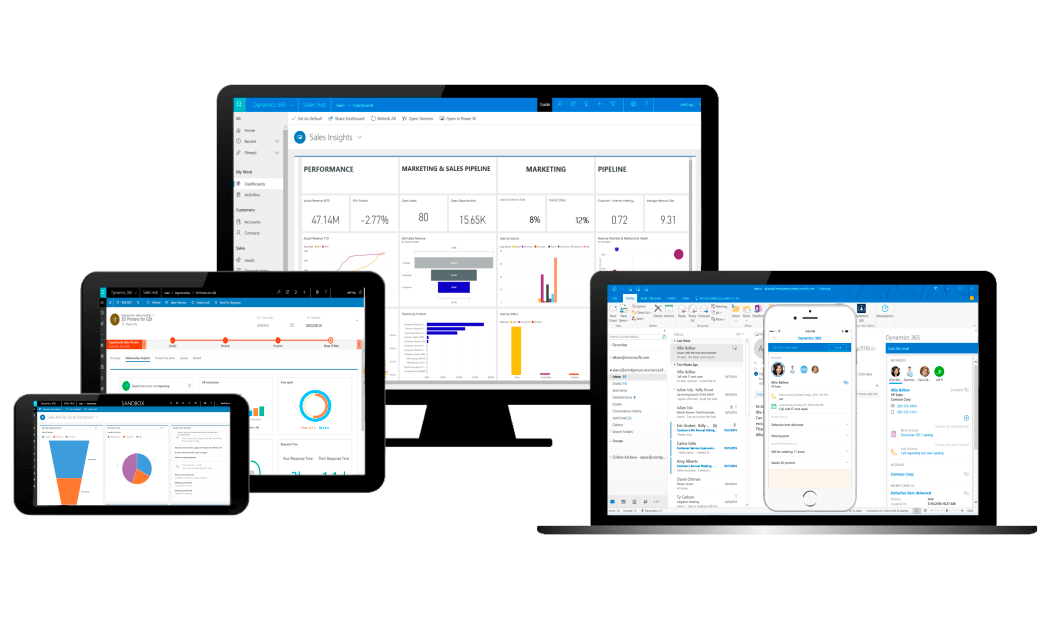

At Codepluse Gen Private Limited, we offer a robust and secure CRM for financial institutions in India tailored to meet the dynamic needs of banks, NBFCs, fintech companies, microfinance firms, and financial advisors. Our CRM platform centralizes your customer lifecycle management, simplifies compliance, and accelerates lead-to-loan conversion with automation at every stage.

At Codeplus Gen, we specialize in developing custom, scalable, and user-friendly software applications designed to meet the unique needs of various industries. With expertise in Fintech, NBFC, Banking, Schools, Colleges, E-commerce, IT, Hospitality, and Healthcare, our team delivers high-performance, mission-critical software solutions that streamline operations, improve user experience, and support long-term business growth. Based in Tamil Nadu, India, our skilled developers focus on creating reliable, flexible, and fully customizable software that enhances efficiency and drives success across all sectors.

Easily manage and monitor your leads with real-time insights using our intelligent lead and opportunity tracking system. Identify top-performing channels, measure conversion rates, and assign follow-ups to the right agents. Our CRM for NBFCs and financial firms in India ensures every potential customer is tracked from first contact to final disbursement.

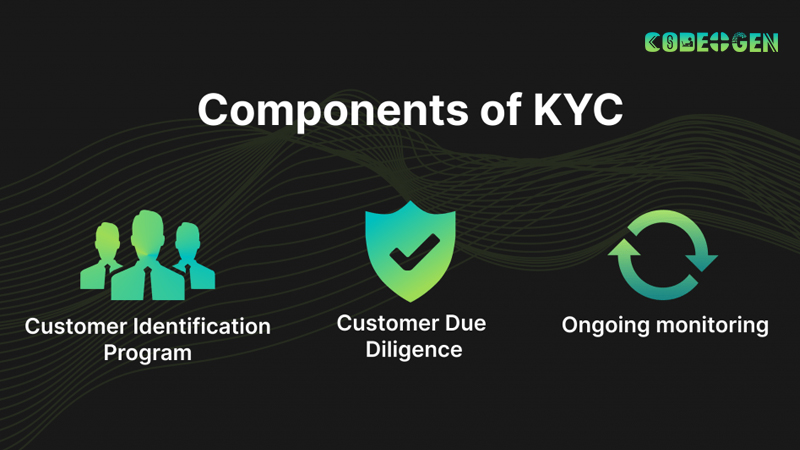

Simplify customer onboarding with end-to-end KYC document collection, verification, and storage. Upload, review, and approve identity and address proofs in a secure environment. Our financial CRM software in India supports Aadhaar, PAN, bank statements, and other regulatory documents in compliance with Indian KYC norms.

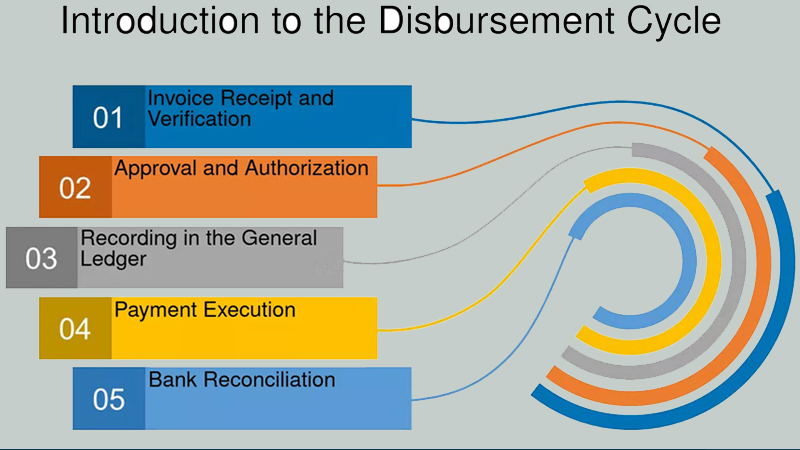

Automate multi-stage approval processes for loan applications, insurance policies, or account setups. Reduce manual intervention with workflow automation tools that ensure speed, accuracy, and transparency. Our CRM enables faster disbursements and fewer errors, streamlining your entire approval chain.

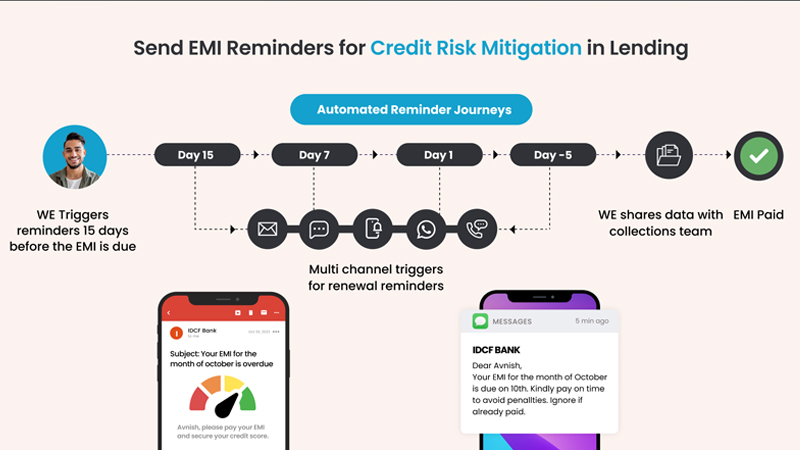

Engage customers through their preferred channels with integrated email, SMS, and WhatsApp CRM automation. Send instant updates, promotional messages, payment reminders, and support notifications—directly from the CRM dashboard. Improve retention and customer satisfaction with multi-channel communication built for finance.

Never miss a due date again. Our CRM includes automated reminders for EMI payments, insurance renewals, and pending customer follow-ups. Boost your collections and customer engagement with timely alerts via SMS, email, and WhatsApp—customized per user or loan profile.

Give every user the tools they need—nothing more, nothing less. Our role-based dashboards allow agents to view leads, managers to monitor performance, and admins to configure system settings. The CRM is structured for secure, segmented access control, ensuring data privacy and operational efficiency.

Speed up approval processes with secure document upload and e-signature support. Customers can upload scanned documents or sign agreements digitally from anywhere. Our CRM ensures bank-level security encryption, ensuring regulatory compliance and customer trust.

Keep customers and agents updated with a real-time loan status tracker integrated into the CRM. From application to approval, disbursement to closure, every step is tracked with auto notifications and alerts, reducing support calls and increasing transparency.

Stay audit-ready with in-built compliance logs and full audit trails for every transaction. Our CRM meets RBI, SEBI, and other regulatory requirements for financial documentation and access history. Maintain 100% transparency and accountability with secure records of every change.

Seamlessly integrate your CRM with core banking systems, Aadhaar APIs, payment gateways, and third-party tools. Our open API architecture enables smooth data exchange between platforms for document verification, fund disbursement, and real-time status syncing.